Group long-term disability (LTD) insurance is an important benefit that can dramatically affect quality of life for orchestra musicians and their families in the event of a disability. Recently, some orchestra musicians have inquired about the content of their orchestra’s long-term disability policies. Negotiating for a good disability policy is essential. The collective bargaining agreement should include the important terms of the policy agreed to and/or include a reference to the specific policy by insurance carrier name, policy number and date. The Orchestra Committee should follow up and review the actual policy to ensure that it complies with the terms negotiated and that summary plan descriptions of the policies are distributed to all orchestra members. The cost of disability insurance policies can vary widely, as can the quality of the insurance carrier in paying benefits to disabled employees. Committees negotiating over limited dollars should determine if any changes in coverage should be explored either from a cost-benefit perspective or with an eye to improving coverage.

Negotiating committee members, along with their representatives, should be familiar with some of the key provisions of group long-term disability insurance policies and the impact of a disability on the musician and the orchestra. Below are some of the most important issues to consider.

1. How Long Will LTD Benefits Continue?

Determining how long benefits will be paid in the event of a disability is one of the most important questions to consider. The answer depends in large part on the definition of disability, whether the definition changes after benefits are paid for a period of time and whether certain types of disabilities have express limitations. The benefits under most policies generally continue to age 65 or social security retirement age. If a musician becomes disabled close to or after age 65, many policies provide that benefits will still be paid for a set period, often five years. But determining the length of coverage in large part depends on the nature of the disability.

A. Own Occupation vs. Any Occupation

This is a very important feature of any long-term disability policy. It determines whether you are disabled under the definition of disability contained in the policy. Policies will usually define disability as the inability to perform “the material and substantial duties” of your regular occupation, but this definition will often hold only for a limited period of time (frequently as short as two years). After that time, policies will often define disability based on whether you are unable to perform any occupation in the labor market for which you are reasonably qualified by education, training or experience. So in negotiating for a disability policy it is critically important to try to get the “own occupation” definition to last as long as possible. In some orchestras, musicians have bargained for the ability to “buy-up” an extension of the “own occupation” period by self-paid premiums.

B. Limits For Certain Disabilites

It has become increasingly common for policies to limit benefits—often to two years—for disabilities arising from mental health and nervous condition issues such as stress, anxiety or depression, and to limit benefits even further—sometimes as short as one year—for disabilities arising from alcohol or drug abuse. Not all policies have these exclusions and it makes sense to periodically review your policy, and perhaps seek a different carrier if efforts to eliminate these exclusions are unsuccessful.

2. How Long Can Disabled Musicians Keep Their Jobs?

This can be a thorny subject, with the Orchestra and the Orchestra Committee weighing fairness to the disabled musician against other considerations. Depending on the player, the section, and the circumstances, keeping the seat open for the disabled musician and using substitutes may be perfectly fine, even for multiple years. In other circumstances, having someone out for an extended time could pose a hardship if a prolonged absence adds unreasonable burdens to the remaining section players or seriously affects artistic quality.

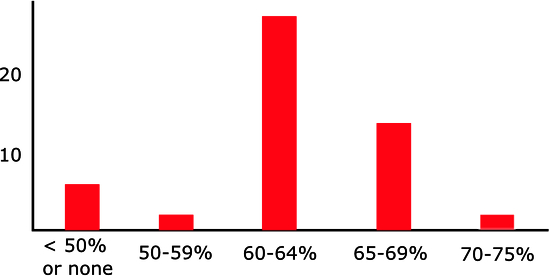

Number of ICSOM orchestras in each tier of disability benefit (as a percentage of income replaced)

Source: AFM-SSD 2013-2014 ICSOM Wage Charts

A number of orchestras have tried to address this question in the collective bargaining agreement. Some provide a process by which after a period of time (often a number of years) a musician can be asked to provide a medical prognosis regarding the likelihood of returning by a certain date, with the right to terminate if the musician can’t make it back within that time. The problem with these provisions (and I have helped draft some of them) is that any blanket date of return may violate disability discrimination laws. Under the Americans with Disabilities Act, if an employee has requested an accommodation, an employee is entitled to return to the same job unless the employer demonstrates that holding the job open would impose an undue hardship. And providing a fixed date of return may not be reasonable, if, for example, the employee can only provide an approximate date, or if an employee knows they won’t be able to return by the fixed date but expects to return within a reasonable additional period of time. The key in all of this is engaging in an interactive process with the disabled musician. While the collective bargaining agreement can provide some parameters, under the ADA one size does not fit all. Accordingly, any contracts that provide a fixed date of return without a process to evaluate the circumstances and engage interactively with the disabled musician should be revised.

3. Other LTD Policy Considerations

A. Cost Of Living Adjustments

If a 40-year old musician suffers a permanent disability, receiving a benefit that is two thirds of today’s salary may be little comfort by age 60. Long-term disability policies can provide that benefits be adjusted either with reference to an outside index or based on raises negotiated for the group covered by the policy. In bargaining for disability insurance, negotiators should determine whether the benefits are indexed to protect against inflation.

B. Employer-Paid, Self-Paid, Or Both?

Employer-provided group disability insurance typically replaces between 60-70% of the musician’s pre-disability income, subject to a maximum monthly benefit under the policy. (The maximum monthly benefit covered under the policy should be included in the collective-bargaining agreement and reviewed and adjusted as wages increase.) The question arises whether employer-paid disability insurance is better than employee-paid disability insurance. If the employer pays the full cost of the premium, all of the benefits are taxable, whereas if the employee pays all or part of the premiums with after tax dollars, the benefits attributable to employee-paid premiums are not taxed. Depending upon the individual circumstances of an orchestra, the ability to pay, and the cost of the insurance, this might be something an orchestra would want to consider. In the event the orchestra decides to switch from employer- to employee-paid disability insurance premiums, the IRS will phase in the non-taxable portion of the benefit for disabilities occurring within a few years after the switch.

C. Policy Exclusions & Limitations

Unlike health insurance under the Affordable Care Act, disability policies most often contain exclusions for pre-existing conditions—i.e. conditions in effect before you were covered by the policy. While many policies contain this type of exclusion, many policies will allow the exclusion to disappear after a period of service. Musicians negotiating or renewing policies should ask about this.

D. Benefit Offsets

Many policies reduce benefits by the amount of income received from other sources, including outside earnings from other employment, any employer-provided retirement benefits, workers compensation benefits and social security disability benefits. It makes little sense for musicians to apply for retirement benefits that are less than their disability benefits if the entire amount will be offset under the disability policy. Some policies require the employee to apply for social security benefits and then take an offset for the entire amount of any retroactive social security award or any payments made to your spouse or children on account of your disability. Of particular concern to musicians is whether the carrier can offset earnings from teaching. If the disabled musician had pre-disability income from teaching, they should contest any attempt to offset like earnings after benefits begin.

E. The Waiting Period

The waiting period determines how long a musician must be absent from work before long-term disability insurance kicks in. Generally, waiting periods can be anywhere from 30 to 180 days—the shorter the waiting period, the more expensive the policy. It may be less expensive to negotiate for increased sick leave and allow sick leave to accrue from year-to-year than to pay for a disability insurance policy with a shorter waiting period. The key issue surrounding the waiting period is to make sure that musicians who are disabled are not left without paid sick leave before long-term disability benefits begin. If your orchestra has a waiting period of less than 180 days it pays to review whether improving sick leave and extending the waiting period might be beneficial.

Not Just Wages

Contract negotiations rightly focus on big-ticket items, and long-term disability insurance is seldom one of them. But coping with a disability can be hard enough without the added stress of serious financial loss. A good LTD policy can be critical in assuring a reasonable quality of life for disabled musicians and their families and may not be unduly costly. Taking the time to review and understand an existing LTD policy, and negotiating for needed improvements, makes good sense.