In June 2013, in United States v. Windsor, the Supreme Court struck down as unconstitutional a provision of the Defense of Marriage Act (“DOMA”) that defined marriage as between a man and a woman for federal law purposes (and applied to over 1,000 federal laws). While we’ve come a long way from “don’t ask don’t tell” in the legal arena, there is still a long way to go before there is complete equality under the law for gay, lesbian, bi-sexual and transgender individuals. DOMA continues to reserve to the states the right to define marriage for all state law purposes and there have been a barrage of legal challenges to state law bans on same-sex marriage. Seven cases from five states had petitioned the Supreme Court to rule on the issue, but in October the Supreme Court declined to hear, and thereby let stand, rulings affecting five states—Indiana, Oklahoma, Utah, Virginia, and Wisconsin—holding that state law bans on same-sex marriage were unconstitutional. The high court’s refusal to decide the question had the ironic effect of deciding the question—bans on same-sex marriage in dozens of states were struck down and numerous appeals courts refused to overturn decisions based on the Supreme Court’s decision not to hear any of the seven petitions seeking review. Most recently, the Supreme Court rejected a request to stay a ruling by a federal court in South Carolina striking down that state’s ban on same-sex marriage.

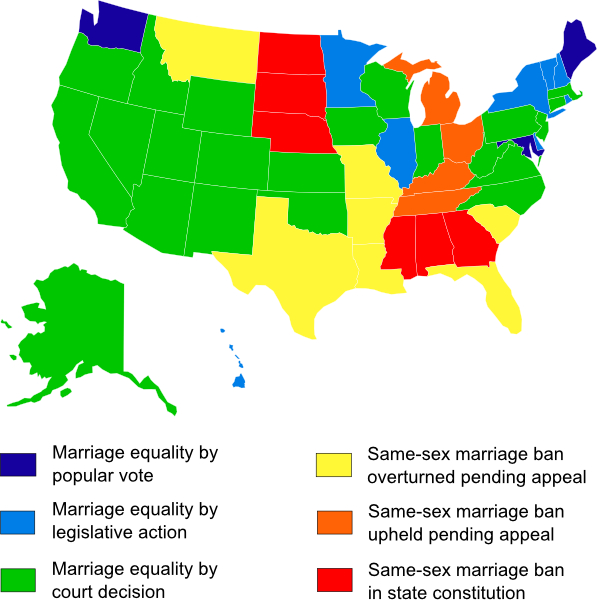

Base map by www.amcharts.com

As of this writing, there are 35 states plus the District of Columbia that recognize same-sex marriage. (Of the 35 states where same-sex marriage is now legal, 24 were the result of court rulings, including in some of the 19 states that passed laws and/or constitutional amendments banning same-sex marriage.) Only 11 states adopted same-sex marriage by legislation (8) or voter referendum (3). The total number of states allowing same-sex marriage would have been 39 if the November 6, 2014, ruling by the 6th Circuit Court of Appeals had not overturned decisions striking down bans on same-sex marriage in Ohio, Michigan, Kentucky and Tennessee. Several states including Louisiana (in which the trial court upheld the ban) and Michigan, Kentucky, Ohio, and Tennessee (in which an appellate court reinstated the ban) have filed petitions seeking review before the Supreme Court while others, including Kansas, have indicated they intend to seek review. The Supreme Court has complete discretion to decide to hear some or all of the cases although the conflict between the 6th Circuit and other courts is often viewed as a compelling reason to accept review. So while the issue could still be headed to the Supreme Court and the legal landscape is rapidly changing, at present there is a patchwork of state regulation to be aware of and, even if the right to same-sex marriage is upheld, there continue to be gaps in federal protection for LGBT individuals.

The Good

At the workplace, perhaps the largest post-Windsor impact is in the area of employee benefits. Most—but not all—employee benefits under ERISA plans are affected. Generally, the rule is that a marriage that is lawful where celebrated (where it took place) determines marital status for all mandated pension benefit requirements, even if the state where the participant resides does not recognize the marriage. Excluded from ERISA protections are church and governmental pension plans. Same-sex spouses must be treated equally with opposite-sex spouses for pension purposes including, for example, with respect to: joint and survivor benefits; pre-retirement death benefits, certain benefits in the event of divorce, rollover distributions, etc. The effect of the Windsor decision also extends to COBRA (the right to continue health care coverage) and HIPAA, as well as FSA, HRA and HSA accounts. Many issues remain unanswered especially with respect to the extent of retroactive rights for persons who were lawfully married yet covered by plans that did not recognize same-sex marriage.

The Bad

With regard to the right to be covered under a same-sex spouse’s health care plan, the news is not as good. Under the ACA, beginning on January 1, 2015, all qualified health insurance issuers must make same-sex coverage available to an employer’s group health plan. However, in a state where same-sex marriage is not recognized, there is no legal requirement for the employer to offer coverage for same-sex spouses under its health care or other insurance policy or under a self-insured plan. With regard to the Family and Medical Leave Act, the issue is still evolving. The Department of Labor has now issued proposed regulations to make the law of the jurisdiction where the marriage took place controlling—changing it from the current definition that uses the law where the employee resides to determine if someone is legally entitled to FMLA leave. But Social Security has a long way to go. It is finally recognizing same-sex marriage—but only if the state in which the person is domiciled also recognizes the marriage or allows the affected spouse to qualify as a spouse under the state’s law governing inheritance without a will. Lawsuits against the Social Security Administration challenging the domicile rule have recently been brought. But for those musicians soon approaching Social Security age, the safest course is to be domiciled in a state that recognizes same-sex marriage.

Other Laws That Could Help

In states where same-sex marriage is not legal, other laws may help persuade employers to permit all married couples, same-sex or not, to be covered under health care plans and to receive other employment benefits. Cases have been brought challenging denials of benefits to same-sex couples who were married in other states under federal or state discrimination laws. In one such case, a man married in a state where same-sex marriage was legal, sought to add his spouse to his health plan in a state where same-sex marriage was not legal. He was not permitted to add his spouse until January 2014 when the plan changed as a result of a new collective bargaining agreement. He then brought suit under ERISA and under Title VII, the law that prohibits sex discrimination in employment. He argued that because he was a male married to a male he was denied the benefits of employment that a similarly situated female employee who was married to a male would receive. The court has refused to dismiss the case and has allowed it to proceed. More cases like this one have been or will be brought. Unless employers provide equal benefits to same-sex and opposite-sex married couples, they too could be subject to suit or ultimate liability. Musicians should make this clear in bargaining.

Additional Issues

Even in states that recognize same-sex marriage, application of the changes to the law can be complicated. In some cases, pension plan terms may have to be amended. Contribution limits in Health Savings Accounts may have to be adjusted. And the form of benefit election in a pension should be reviewed. Orchestra members should be given notices to understand and protect their rights. For example, in the area of defined pension benefits, spousal consent is required to elect something other than a “joint and survivor” form of benefit. The IRS has indicated that if a person intends to designate someone other than their same-sex spouse (such as a child) to receive benefits and dies before providing a new designation showing spousal consent, their intended designation could be void. Musicians in a same-sex marriage should check to make sure that all of their beneficiary designations are in compliance with recognition of their marriage. A participant who is now married under the plan’s rules but wasn’t recognized as married before, might have to complete new designation forms. HR personnel should be alerted to these issues as well. Plan and insurance contracts should be reviewed by the committee and union to make sure they comply.

Domestic Partners

Another potential employment issue that could arise involves what happens with domestic partner benefits. While a health or pension plan may now be required to cover same-sex married spouses if it provides benefits to any spouses, a requirement to continue to provide domestic partner benefits to unmarried partners is less clear in states where same-sex marriage is now legal. While there may be tax and other incentives for same-sex couples to marry, it hardly seems prudent to require existing domestic partner couples to now marry in order to qualify for benefits. Musicians may want to review this issue and address it in bargaining.

Possible Impact of Claims Based on Religion

The Supreme Court’s 2014 5-4 decision in the Hobby Lobby case has been some cause for concern in this area. In that case, the Court upheld the right of a Chapter S corporation under the Religious Freedom Restoration Act to refuse to provide an employee health care plan that included contraceptives based on the religious beliefs of its owners. However, under the ACA, the Obama administration had granted waivers to religious non-profit corporations, demonstrating to the majority of the Court that the need for the regulation was not compelling. The same facts would not apply in a case seeking to maintain an unconstitutional or statutory prohibition on the recognition of same-sex marriage

Sexual Orientation Protection Still Falling Short

While the issue of marriage equality has made great strides in the benefits area, the law still falls short on banning discrimination in the workplace on the basis of sexual orientation. Recently, by executive order, President Obama prohibited sexual-orientation and gender-identity discrimination among federal contractors, and the Supreme Court has held that sexual stereotyping and same-sex sexual harassment is prohibited by Title VII. But most courts have held that sexual orientation discrimination—which is not specifically mentioned in the statute—is not protected under Title VII. Given the recent election, action on a bill to expressly ban discrimination on the basis of sexual orientation and sexual identity seems unlikely in the near term, although one passed the Senate in November 2013 and was blocked in the House. Nevertheless, the EEOC has been very active in this area and has processed charges and filed a number of cases on behalf of LGBT individuals. Many states and municipalities also ban discrimination on the basis of sexual orientation. So at least while a democratic administration remains in office, there is hope on the horizon that the combination of state and local laws that outlaw sexual orientation discrimination and a pro-active EEOC will continue to make progress.

The Collective Bargaining Agreement

Many collective bargaining agreements contain non-discrimination clauses and may also define entitlements to benefits. These should be reviewed and updated to include prohibitions against discrimination on the basis of sexual orientation and gender identity and to make sure that they do not limit benefits to spouses in opposite sex marriages. If there are policies in place covering harassment, they should also be reviewed with an eye toward extending explicit protections for sexual orientation and gender identity if they do not already do so.